The jurisdiction of the BBMP is divided into six value zones, based on the guidance value published by the Department of Stamps and Registration. The computation of property tax is done by multiplying the area of the property by per sq ft tax rate per month (UNIT) that is fixed on the basis of location of the property (AREA) and multiplied by current property tax rate (VALUE). The UAV is based on expected returns from the property, depending upon its location and nature of usage of the property.

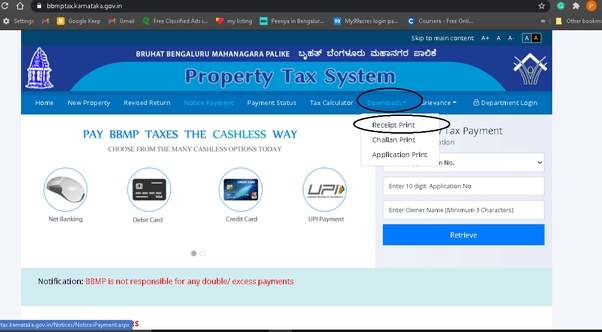

The BBMP follows Unit Area Value (UAV) system, for calculating the amount of property tax. The municipal body utilises these funds to provide civic facilities in Bengaluru. Owners of properties in Bengaluru are liable to pay property tax to Bengaluru Municipality body called Bruhat Bengaluru Mahanagara Palike (BBMP) every year. In this article we will be simplifying property tax levied by Bengaluru municipality and tax benefits of property tax to help our readers understand and plan their bangalore property tax payment in a better way.Ībout Bruhat Bengaluru Mahanagara Palike Property Tax

So owning a property has its own complications and understanding the nuances of property tax is also important for an individual in finance and tax planning as well. Property that is included for property tax purpose generally includes independent building (residential and commercial), Flats and apartments, Shops, Godowns, vacant land etc.

Property tax being governed by State Government and further delegation to various municipalities results in difference in basis of levy, computation, mode and manner of its payment. Property tax levy is delegated to various municipalities within the states to ensure efficient and smooth maintenance of civic amenities in various localities such as maintenance of local roads, drainage, cleanliness in the area, public parks etc.

0 kommentar(er)

0 kommentar(er)